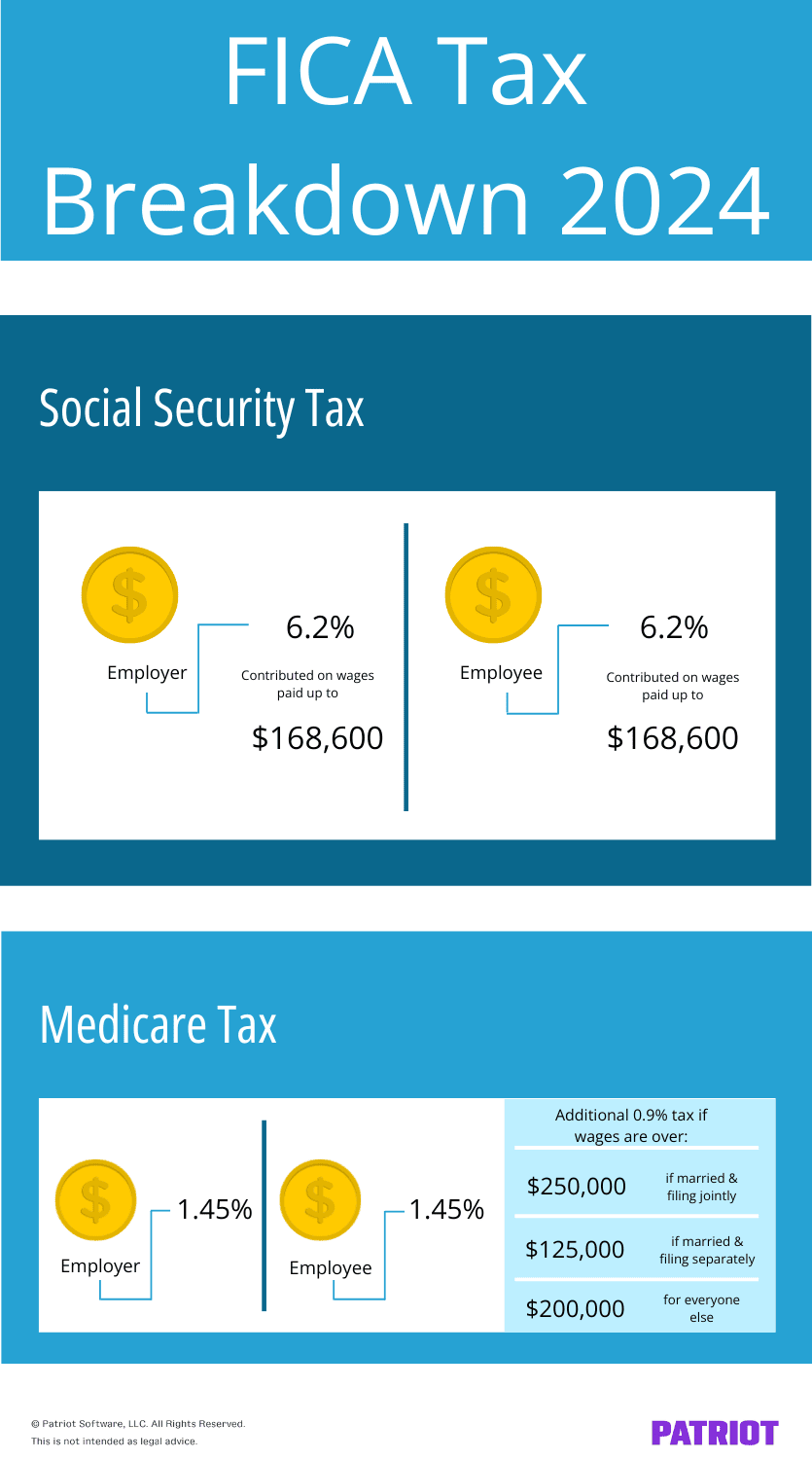

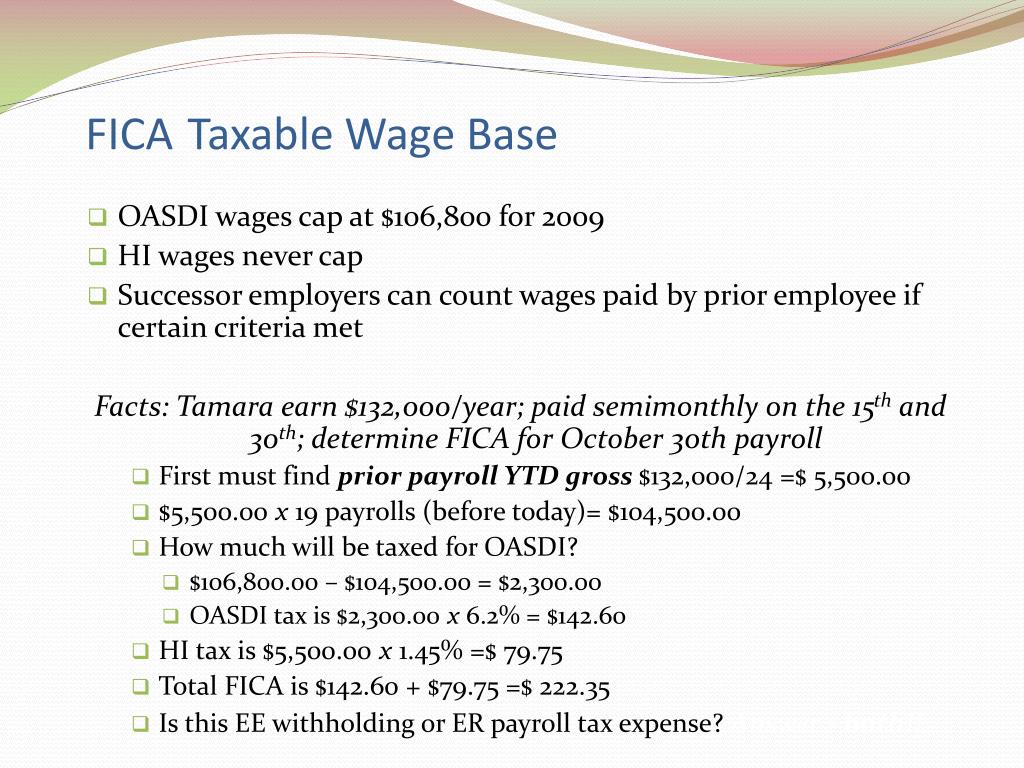

2025 Max Fica Wages. The maximum 2025 social security component of the federal insurance contributions act tax payable by each employee will be $10,918.20, or 6.2% of the taxable. The fica tax rate for employers will remain at 7.65% in 2025 — 6.2% for social security and 1.45% for medicare, the same as in 2025.

We call this annual limit the contribution and benefit base. For 2025, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2025).

2025 Max Fica Wages Hope Beverlie, So, for 2025 employers must withhold the following amounts:

2025 Max Fica Wages Hope Beverlie, This amount is also commonly referred to as the taxable maximum.

What Is Fica Limit For 2025 Dacia Dorotea, The social security tax limit will rise to $176,100 in 2025.

What Is The Fica Limit For 2025 For Self Employed Nessa Shanna, This amount is also commonly referred to as the taxable maximum.

Sf Minimum Wage 2025 Sibel Corrinne, This amount is also commonly referred to as the taxable maximum.

2025 Maximum Fica Withholding Erena Jacenta, When ssa releases the final social security taxable wage base number for 2025, likely in october, we’ll let you know.

Learn About FICA, Social Security, and Medicare Taxes, In 2025, retirees receiving social security benefits will be able to earn $62,160 in the year they reach full retirement age before their benefits are reduced by $1 for every $3 in.

What Are Payroll Taxes? Varieties, Employer Obligations, & Extra, 6.2% social security tax on the first $176,100 of employee wages (maximum tax is $10,918.20;

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Ssa Wage Limit 2025 Cyndi Rebecca, The maximum fica tax imposed will be $10,918 ($176,100 x 6.2%), and there is no cap on the 1.45% medicare tax.